Customer Lifetime Value (CLV) Calculator

Estimated Customer Lifetime Value (CLV)

$0.00

CLV to CAC Ratio

0 : 1

Customer Lifetime Value (CLV) Calculator: A Powerful Tool for Business Growth

Customer Lifetime Value Calculator helps you estimate how much revenue or profit a customer will generate during their entire relationship with your company.

Whether you’re running a SaaS business, an e-commerce store, or any other business model, knowing your CLV is a game-changer when it comes to optimizing marketing spend, improving customer retention, and driving long-term growth.

What is Customer Lifetime Value (CLV)?

Customer Lifetime Value (CLV) is a metric that calculates the total revenue a business expects to earn from a customer over the duration of their relationship. It helps businesses understand customer behavior, gauge their marketing efficiency, and forecast future revenue.

A CLV Calculator takes into account various inputs to give you an estimate of how valuable each customer is. This number is critical for:

- Determining the effectiveness of customer acquisition efforts.

- Evaluating retention strategies and identifying the most valuable customer segments.

- Calculating the profitability of acquiring new customers versus retaining existing ones.

For a practical cost-analysis example, check out the Military PPM Calculator at ppmcalculator.com — it helps calculate reimbursements and expenses for personally procured military moves.

How to Use a Customer Lifetime Value (CLV) Calculator

The CLV Calculator asks for specific inputs based on the business model you’re using. Let’s break it down for two common models: SaaS (Subscription-based businesses) and E-commerce.

For SaaS / Subscription Models:

- Average Revenue Per User (ARPU): The average monthly or annual revenue generated per customer.

- Customer Churn Rate: The percentage of customers who cancel or do not renew their subscriptions.

- Gross Margin: The profit margin after deducting the cost of goods sold.

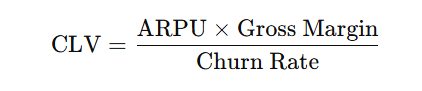

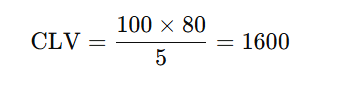

The CLV formula for SaaS is: CLV=ARPU×Gross Margin/Churn Rate

Example: If ARPU is $100, churn rate is 5%, and gross margin is 80%, the CLV would be: CLV=100×80/5=1600

This means each customer is worth $1,600 over their lifetime.

For E-commerce Models:

- Average Order Value (AOV): The average amount spent per order by customers.

- Purchase Frequency: The average number of times a customer makes a purchase in a year.

- Customer Lifespan: The average number of years a customer continues to make purchases.

- Gross Margin: The profit margin after deducting the cost of products sold.

The CLV formula for e-commerce is:

CLV=AOV×Purchase Frequency×Customer Lifespan×Gross Margin

Example: If AOV is $50, frequency is 4, lifespan is 3 years, and margin is 60%, the CLV would be: CLV=50×4×3×0.60=360

This means each customer is worth $360 over their lifetime.

A Customer Lifetime Value Calculator tells you how much each client is worth over time, but those insights are only meaningful with clean data. Marketers often use a verified B2B email list to improve customer targeting, while LFbbd accurate B2B data ensures projections reflect real buyer behavior.

Why Do You Need a CLV Calculator?

- Optimize Marketing Spend: The CLV Calculator helps businesses understand how much they should spend on acquiring customers, based on the value a customer brings over time. For example, if your CLV is $1,000, spending $200 to acquire a customer is a profitable investment.

- Customer Retention and Engagement: By calculating CLV, you can identify your most valuable customer segments. This enables targeted retention strategies like loyalty programs, exclusive offers, or personalized engagement to keep high-value customers happy and reduce churn.

- Revenue Forecasting: CLV provides insight into future revenue based on customer behavior. It helps businesses forecast expected returns and plan for scaling or improving operations.

- CAC vs. CLV Ratio: The Customer Acquisition Cost (CAC) to CLV ratio is crucial for assessing the health of your business. A higher CLV compared to CAC indicates that your customer acquisition efforts are profitable. This ratio is especially important for SaaS businesses and e-commerce stores looking to optimize their marketing efforts.

How Does the CLV to CAC Ratio Affect Your Business?

The CLV to CAC ratio measures the relationship between the lifetime value of a customer and the cost of acquiring that customer. The ideal ratio is typically 3:1, meaning for every dollar you spend on customer acquisition, you should earn three dollars in customer lifetime value.

- Healthy Ratio (3:1 or higher): This indicates that your customer acquisition efforts are profitable, and your business model is sustainable.

- Needs Improvement (1:1 to 3:1): A ratio in this range suggests that while your business is growing, you may want to adjust your marketing strategies or improve customer retention efforts.

- Unsustainable Ratio (below 1:1): If your CAC exceeds your CLV, you’re spending more to acquire customers than they’re worth, which signals an unsustainable business model.

Who Should Use the CLV Calculator?

- SaaS Businesses: Whether you’re in B2B or B2C SaaS, CLV is crucial for understanding customer retention and long-term profitability.

- E-commerce Companies: E-commerce businesses can use CLV to forecast sales, optimize pricing strategies, and identify high-value customers for personalized marketing.

- Marketers: Marketers can use CLV to refine their advertising strategies, focusing on high-value customers and improving retention to reduce churn.

- Investors: Investors use CLV to assess the potential profitability of a business, particularly its sustainability and long-term revenue growth.

- Customer Success Managers: By understanding CLV, these teams can focus on nurturing valuable customer relationships, improving satisfaction, and boosting customer lifetime.