Ecommerce Profit Margin Calculator

Net Profit:

Net Profit Margin:

Ecommerce Profit Margin Calculator: How to Calculate and Use It Effectively

Ecommerce business owners often face the challenge of determining whether their pricing strategies are yielding the expected profit. If you’ve ever wondered, “How do I calculate my profit margin?” or “What is the formula for ecommerce profit margin?”, you’re not alone.

The Ecommerce Profit Margin Calculator is the perfect tool to help you answer these questions and make informed decisions that directly impact your bottom line.

What Is an Ecommerce Profit Margin?

The profit margin in ecommerce refers to the percentage of revenue remaining after all expenses related to the production and sale of a product are deducted. It provides valuable insight into your business’s profitability by reflecting how much of your sales income is converted into actual profit.

There are two common types of profit margins:

- Gross Profit Margin: This is the percentage of revenue left after subtracting the Cost of Goods Sold (COGS). It does not account for operating expenses like marketing or salaries.

- Net Profit Margin: This takes into account all expenses, including operating costs, interest, and taxes, providing a more comprehensive view of profitability.

For ecommerce businesses, gross profit margin is especially important as it helps determine the efficiency of production and sales processes.

Why Is the Ecommerce Profit Margin Important?

Knowing your profit margin is essential for several reasons:

- Pricing Strategy: By understanding your margin, you can set prices that ensure sustainable profitability.

- Cost Control: It highlights areas where you can reduce costs or increase efficiency without sacrificing product quality.

- Business Growth: A higher profit margin allows you to reinvest in marketing, product development, and expanding your business.

How to Calculate Your Ecommerce Profit Margin

Using an Ecommerce Profit Margin Calculator simplifies this process. Here’s how you can calculate your margin step by step:

- Item Revenue: This is the selling price of your product. For example, if you sell a t-shirt for $49.99, this is your item revenue.

- Cost of Goods Sold (COGS): This includes the direct cost to produce or acquire the product, including manufacturing, shipping, and handling costs. For instance, if it costs you $20.00 to make or buy the t-shirt, this is your COGS.

- Additional Costs: These are operational costs that support the sale of your product, such as marketing, transaction fees, and packaging. For example, if you spend $10.00 on marketing per shirt, that’s your additional cost.

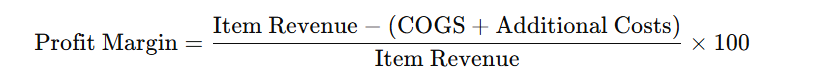

Once you have these numbers, the formula for the profit margin is:

Profit Margin=Item Revenue−(COGS+Additional Costs)/Item Revenue×100

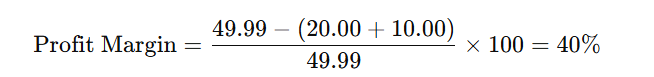

Example:

- Item Revenue = $49.99

- Cost of Goods Sold (COGS) = $20.00

- Additional Costs = $10.00

Profit Margin=49.99−(20.00+10.00)/49.99×100=40%

In this case, your profit margin would be 40%, which means you’re keeping 40% of your revenue as profit after covering your costs.

Practical Uses of an Ecommerce Profit Margin Calculator

Here are some real-world scenarios where an Ecommerce Profit Margin Calculator can be a game-changer:

- Product Comparison: You can quickly compare the profitability of different products in your inventory by calculating their respective profit margins. This helps you prioritize high-margin items.

- Pricing Adjustments: If you find your profit margin is lower than expected, you can make adjustments to your pricing strategy or reduce costs by optimizing supply chain processes.

- Business Decisions: When deciding on new products to add to your store or whether to continue with existing items, knowing your profit margins helps you assess potential returns.

How the Ecommerce Profit Margin Calculator Helps Optimize Your Business

Using an Ecommerce Profit Margin Calculator like the one offered by LFBBD ensures that your business is operating with clear financial insights. It can:

- Improve Decision Making: Empower your team to make data-driven decisions about pricing, marketing, and product management.

- Focus on High-Margin Products: Identify and promote the products that provide the best returns, ensuring your resources are aligned with your most profitable offerings.

- Drive Growth: Optimize your profit margin over time by analyzing trends, reducing unnecessary costs, and investing in the right areas to maximize returns.

If you’re looking to dive deeper into ecommerce data and analytics, LFBBD’s Ecommerce Data offers a comprehensive resource to help optimize your lead generation and financial analysis.