SaaS Churn Rate Calculator

Customer Churn Rate

0.00%

Gross MRR Churn

0.00%

Net MRR Churn

0.00%

SaaS Churn Rate Calculator: The Ultimate Tool for Tracking Customer and Revenue Retention

The SaaS Churn Rate Calculator is an essential tool for businesses aiming to understand their customer retention and evaluate the impact of churn on their revenue. By calculating how many customers you lose over a given period, you can pinpoint areas of improvement and adjust your strategies for better customer success.

What is a SaaS Churn Rate?

Churn rate is the percentage of customers who discontinue using your service within a set period. For SaaS businesses, high churn rates are often a sign of dissatisfaction, poor product-market fit, or ineffective customer support. Reducing churn is crucial for growing a sustainable business.

There are two key types of churn metrics that a SaaS Churn Rate Calculator typically tracks:

- Customer Churn Rate: Measures the percentage of customers lost during a specific period.

- Revenue Churn Rate (MRR): Focuses on how much revenue is lost due to customer churn, including the impact of downgrades and lost subscriptions.

How to Calculate Churn Rate Using the SaaS Churn Rate Calculator

To use the SaaS Churn Rate Calculator, you’ll need to input key metrics:

- Customer Churn:

- Customers at Start: The number of active customers at the beginning of the measurement period.

- Customers Churned: The number of customers who unsubscribed, canceled, or didn’t renew their subscription during the period.

- Revenue Churn (MRR):

- MRR at Start: Your Monthly Recurring Revenue at the beginning of the period.

- MRR from Churned Customers: The portion of MRR lost due to churned customers.

- MRR from Upgrades: Any additional revenue gained from customer upgrades.

After entering this data, the tool calculates:

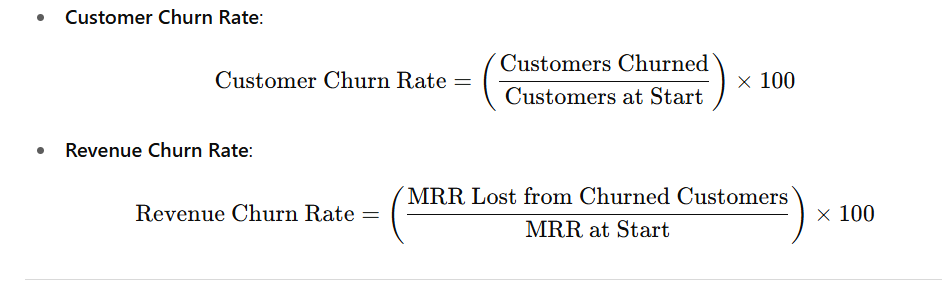

- Customer Churn Rate:

- Revenue Churn Rate:

Real-World Example of Using a SaaS Churn Rate Calculator

Let’s say your SaaS company has:

- 1,000 customers at the start of the month.

- 50 customers churned.

- Your Monthly Recurring Revenue (MRR) at the start is $50,000.

- The MRR lost from churned customers is $2,500.

Using the SaaS Churn Rate Calculator, you would get:

- Customer Churn Rate:

(50/1000)×100=5%

This means you’ve lost 5% of your customer base.

- Revenue Churn Rate:

(2500/50000)×100=5%

This means you’ve lost 5% of your monthly recurring revenue.

Who Needs a SaaS Churn Rate Calculator?

- SaaS Business Owners: By tracking churn, owners can gauge the overall health of their business, identify potential issues, and take corrective action.

- Customer Success Teams: Churn data helps customer success managers target at-risk customers, implement retention programs, and improve customer satisfaction.

- Marketing and Sales Teams: Understanding churn helps marketers refine customer targeting and improve retention campaigns.

- Investors: Investors look closely at churn rate to assess the sustainability of a business. A high churn rate can be a red flag, while a low churn rate signals stability and long-term growth potential.

Why Is Reducing Churn Crucial?

Reducing churn is one of the most effective ways to grow a SaaS business. A high churn rate means you’re constantly acquiring new customers just to replace the ones you lost, which can be expensive and unsustainable. By using a churn rate calculator, you can:

- Identify customer pain points and improve your product.

- Implement more effective onboarding processes.

- Offer personalized customer support to increase satisfaction and reduce cancellations.

For businesses looking to dive deeper into customer data, LFBBd SaaS Database offers comprehensive tools and databases that can help further optimize customer acquisition and retention strategies.