SaaS CAC Calculator

If you’re running a SaaS (Software as a Service) business, understanding your Customer Acquisition Cost (CAC) is essential for making data-driven decisions and optimizing your growth strategy.

The SaaS Customer Acquisition Cost Calculator is a simple yet powerful tool designed to help businesses like yours determine how much it costs to acquire each new paying customer. But how do you calculate it? And why is it so important?

What is a SaaS Customer Acquisition Cost (CAC)?

Customer Acquisition Cost (CAC) is the amount of money you spend on sales and marketing efforts to acquire a new paying customer. For SaaS businesses, where customer lifetime value (LTV) is a critical factor in overall profitability, knowing your CAC is essential for sustainable growth.

In simple terms, CAC answers the question: How much do we need to spend to gain one new customer? This metric helps businesses evaluate their marketing efficiency and sales processes, ensuring that their acquisition efforts are cost-effective.

Why Should SaaS Businesses Care About CAC?

SaaS businesses are built on recurring revenue from customers. Therefore, understanding CAC is crucial to making sure that you’re not spending more to acquire customers than you’re able to make from them over time. Here’s why tracking CAC matters:

- Optimizing Marketing and Sales: By identifying the cost-effectiveness of your marketing channels, you can reallocate your budget to the highest-performing strategies.

- Ensuring Profitability: If your CAC is too high, it might signal an inefficient use of marketing funds. A lower CAC allows you to scale profitably.

- Attracting Investors: Investors closely monitor the LTV:CAC ratio. A strong ratio shows that your business model is sustainable and scalable, which can attract funding.

Visit our SaaS Leads Database or Startup leads Database to access real-time, verified leads tailored to your business needs. With over 10 years of expertise and a database of 100K+ companies, we provide the insights and opportunities you need to fuel your growth.

How to Calculate SaaS Customer Acquisition Cost (CAC)

Calculating CAC involves a straightforward formula that measures the total costs associated with acquiring new customers. Here’s how to do it:

- Total Sales & Marketing Expenses:

Include all expenses related to acquiring customers. This might consist of:- Paid ads (Google, Facebook, etc.)

- Salaries for your sales and marketing teams

- Software subscriptions (CRM, email marketing, etc.)

- Content marketing and promotional costs

- Number of New Customers Acquired:

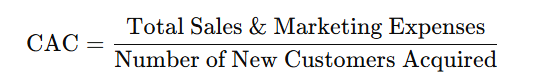

Count the total number of new, unique paying customers acquired during the same time period. - Formula:

The formula is simple: CAC=Total Sales & Marketing Expenses/Number of New Customers Acquired

Real-World Example: How to Use the SaaS CAC Calculator

Let’s say your SaaS business spent $50,000 on sales and marketing over the past quarter. During that time, you acquired 500 new customers.

Using the CAC formula, the calculation would look like this: CAC=$50,000/500=$100

This means that it costs you $100 to acquire each new customer. With this data, you can assess whether your marketing efforts are sustainable or if changes need to be made.

How Does a SaaS CAC Calculator Help You?

A SaaS CAC Calculator simplifies this process by automating the calculation, allowing you to focus on making informed decisions based on the data. Here’s how it can help:

- Immediate Insights: The calculator instantly provides you with a clear understanding of your CAC, saving you time and effort.

- Better Budgeting: By inputting your marketing expenses and customer data, the calculator helps identify which channels are most cost-effective, enabling better allocation of resources.

- Data-Driven Decisions: With real-time, accurate CAC calculations, you can make smarter decisions about customer acquisition strategies, optimizing for maximum ROI

What Affects Your SaaS CAC?

Your CAC can fluctuate based on several factors. Here are some key elements that influence this cost:

- Marketing Channels: If you're investing heavily in paid ads, your CAC may be higher. On the other hand, organic strategies like SEO might result in a lower CAC over time.

- Sales Cycle: The length and complexity of your sales cycle impact how much you spend on acquisition. Longer cycles often result in higher CAC due to more personnel time and resources.

- Customer Retention: Higher retention rates typically mean lower CAC in the long run. If you have strong customer success practices and keep churn low, it reduces the need for heavy marketing spend.

- Pricing and Product Offering: If you offer a high-priced product, your CAC can be higher. However, this can be offset if the lifetime value (LTV) is also high.

How to Optimize Your SaaS CAC

If your CAC is too high, don’t worry—there are several strategies you can implement to bring it down and improve efficiency:

- Refine Your Targeting:

Focus on acquiring high-value customers who are more likely to stay and spend more, thus increasing LTV. - Improve Conversion Rates:

Optimize your sales funnel by improving landing pages, enhancing customer onboarding, and reducing friction in the buying process. - Leverage Organic Growth Channels:

Invest in SEO and content marketing for long-term growth. While these channels take time to build, they often have a lower CAC once established. - Use Automation Tools:

Use marketing and sales automation tools to streamline processes, reduce human error, and decrease the time spent on each lead. - Optimize Customer Retention:

Focus on retaining customers longer and upselling them to higher-tier plans. A loyal customer base reduces the need to constantly acquire new customers.